The promise of rising interest rates could be a positive for cyclical stocks that historically beat the market when the cost of borrowing goes up.

Subscribe now for unlimited access.

$0/

(min cost $0)

or signup to continue reading

For banks, infrastructure and utilities, which have ridden the zero-bound of interest rates to great heights, the outlook could be less favourable.

A greater sense of urgency over how soon to raise rates at the United States Federal Reserve has emerged after minutes of the last meeting showed the centrla bank is increasingly swayed by the threat of inflation. On Wednesday, Goldman Sachs rescinded its view that the Reserve Bank of Australia will cut interest rates so that all of the major economists now agree the next move for the Australian cash rate will be up.

Low rates have been almost indiscriminately good for shares, but once the global rates cycle advances towards tightening, sector selection will arguably become more important.

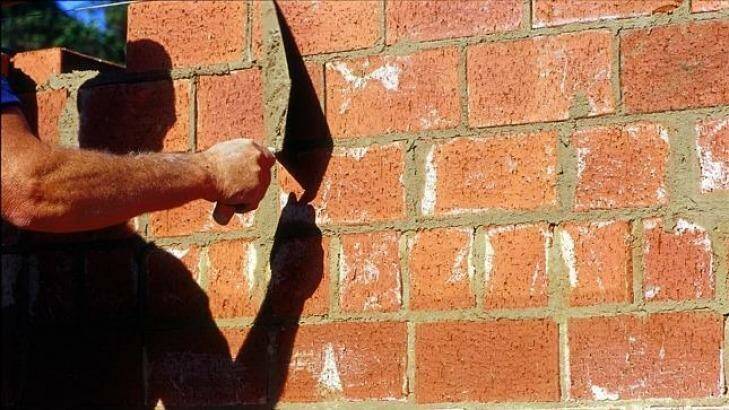

Russell Investments' investment strategist for Asia-Pacific, Graham Harman, said that cyclical stocks such as building materials – where earnings are tied to the economic cycle – tend to do well in a rising interest rate environment.

"[A] rising interest rate environment would be a sign that a bit of a pulse is coming back into the economy," he said. "Particularly given the fact that it's been a long journey out of financial crisis and things have been reasonably lacklustre and downbeat ... we're now much closer to the phase where [rates are] a sign of strength."

Cyclicals will do well from any rebound in revenue growth because companies have been working hard on reducing their expenses. Any turnaround in sales, when it finally comes, will have exponential benefits for earnings. "That's really powerful for the profit story, we haven't seen that yet," Mr Harman said. That rebound is not imminent, especially in light of the RBA's downgrade of growth and inflation forecasts for this year.

Investors will also have to wrestle with what to do with their bank stocks, which have been embraced as defensives even though they are leveraged to the economy. The benign bad debt environment thanks to low rates has paved the way for banks to deliver annuity style returns with low volatility and capital growth, an attractive proposition for investors who switched out of cash or fixed income into equities this cycle.

"That story comes to an end as rates stop falling," said Mr Harman of the march out of term deposits and into bank shares. While rising rates are not bad for the profitability of banks, because they can put up their lending rates faster than they can put up their deposit rates, their earnings have not been the dominant driver of investor behaviour in the same way that the need for yield has.